People should be able to understand their paycheck without needing to solve a riddle. Yet for millions of people, taxes remain one of the most confusing parts of personal finance. Federal rules change, state laws differ wildly, and deductions can shift your take-home pay in ways that are hard to predict. The digital solution Taxtools exists to cover two opposing forces which create complicated tax systems, while enabling people to understand their financial situation.

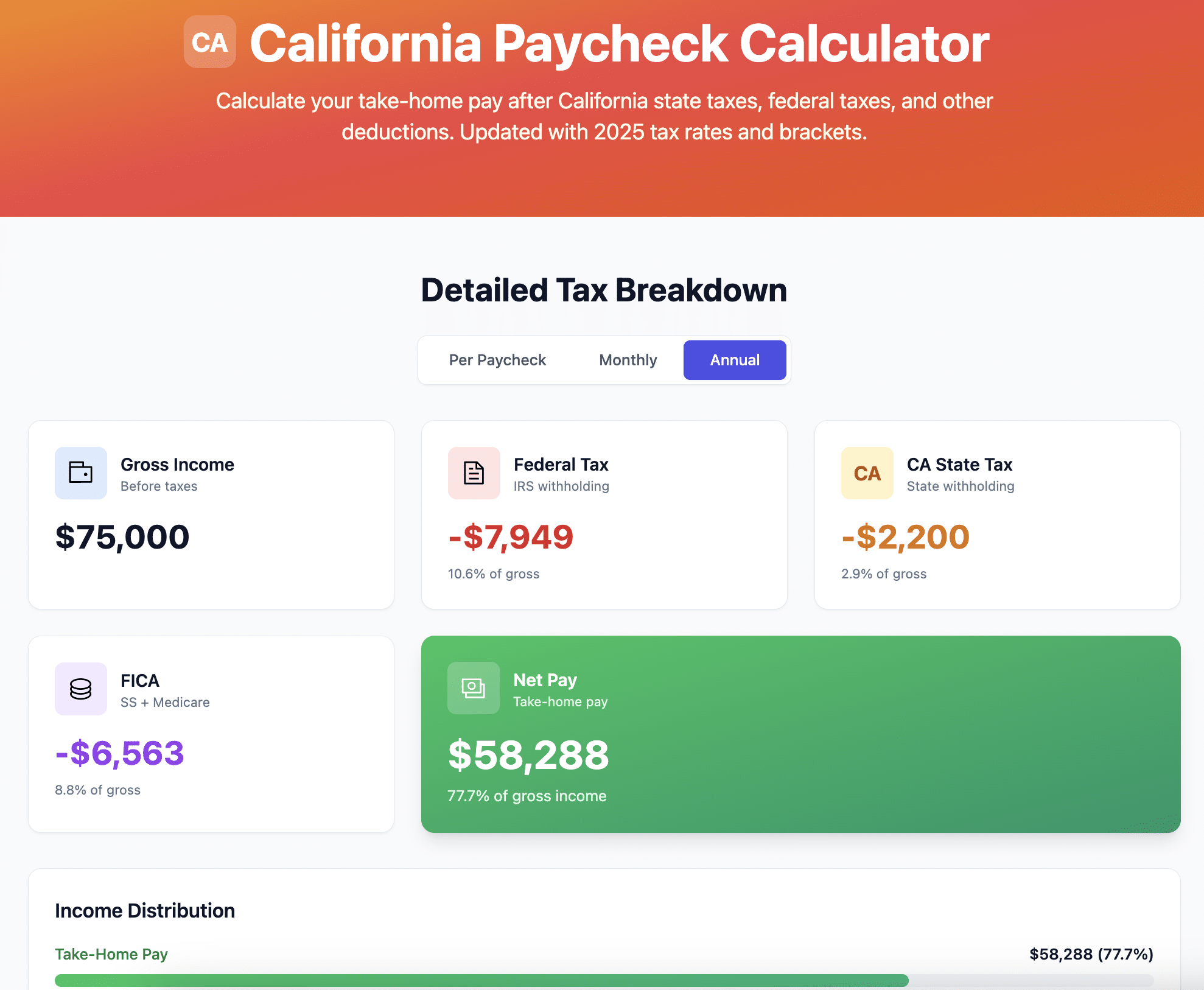

Taxtools operates as a comprehensive system which users can access through its california salary calculator function. The system provides users with an easy-to-use interface which shows them how their income and deductions will impact their tax obligations. Taxtools transforms complex numerical data into practical solutions which users need to handle their job offer evaluations, relocation plans, salary negotiations, and precise budgeting needs.

Why Salary and Tax Calculations Are So Confusing

People use their salary as their total income measurement. Salary represents the initial wage assessment which requires additional evaluation. Your actual bank account balance after tax and deduction costs shows your real income value.

The process becomes more complicated because of these three elements:

- Federal income tax brackets

- State and local taxes

- Social Security and Medicare contributions

- Pre-tax deductions (health insurance, retirement plans)

- Post-tax deductions (wage garnishments, certain benefits)

The three variables change according to your location and your employment details and your tax filing method. Two individuals with the same salary in different states will receive different net income amounts. The same state shows different income results because of filing status or benefit selections.

What Is Taxtools?

Taxtools stands as a digital platform which enables users to conduct tax calculations based on their income and salary. The system uses current operations to calculate pay based on actual work conditions instead of requiring users to search through tax tables or estimate their deductions.

The main function of Taxtools enables users to estimate their net income based on their gross salary or hourly wage. The system helps users comprehend the impact of taxes on their earnings. The system enables users to assess their earnings between different states. The system enables users to make financial plans with complete assurance.

Taxtools provides advanced calculation features that go beyond what standard calculators deliver because it needs detailed results. The system shows users the real tax system while people want to see a different taxation system.

Best Importance of Accurate Salary Calculations

Organizations depend on precise salary assessments to obtain essential financial information which enables them to make effective financial choices.

Job Offer Comparisons

When people assess job offers, they tend to consider only the gross salary amount. Yet, people who receive higher salaries in one state will obtain lower take-home pay than those who accept lower salaries in other states.People make wrong decisions when they lack access to an accurate calculator which shows them precise financial data.

Taxtools enables you to evaluate different scenarios through realistic comparisons which show you the true impact of each offer on your personal lifestyle.

Budgeting and Financial Planning

Your actual monthly income establishes your budget which includes expenses for rent and utilities and saving targets and discretionary spending. People who estimate their net income do so because they want to understand their spending and saving limits.

Taxtools enables users to build their budgets through precise personal financial assessments which remove the need for standard financial estimations.

State Taxes: Why Location Matters More Than You Think

The primary factor which determines employee salaries in various states is state taxation. Some states impose high income taxes, other states have no income taxes, and many states maintain tax rates between these two extremes.

California: High Earnings, High Complexity

The state of California operates its taxation system through multiple income brackets which implement progressive tax rates. The state taxation system in California reduces the quantity of income that employees receive from their employment.

The Taxtools California salary calculator provides accurate salary results because it uses reliable data which shows California residents and job seekers their post-deduction earnings. The system proves especially useful for businesses which offer their employees variable salary structures that include bonuses together with stock options.

New York: State and Local Layers

New York City residents face extra challenges because of the additional complexities which New York State presents. Workers need to fulfill their obligations by paying both federal income taxes and state income taxes together with the local taxes that apply to them.

Taxtools provides users with a dedicated NY tax calculator which enables them to navigate through the complex tax system. The tool provides users with a simple result which shows all

tax elements through a single display without requiring them to do any manual calculations.

Supporting Freelancers and Independent Workers

Freelancers and independent workers need our support. The world of work now includes people who earn money through means other than conventional employment. Freelancers and contractors and gig workers find themselves facing greater tax confusion because the system fails to provide them with automatic tax deductions. People who lack automatic tax deductions face difficulty in determining their required tax savings.

Taxtools enables independent workers to calculate their tax needs while determining their quarterly payment schedule and preventing unexpected tax costs during the tax season. The Taxtools system shows freelancers how their income converts into tax liabilities which helps them manage their business finances through implementation of systematic procedures instead of relying on uncertain methods.

Financial trust develops through transparent practices.

Taxtools presents its users different benefits which they fail to see as vital resources after analyzing its various features. People achieve financial control through their understanding of financial matters.

Financial anxiety often comes from uncertainty:

Am I saving enough?- Can I afford this rent?”

Why is my paycheck smaller than expected?

Taxtools delivers numerical data together with peace of mind. People develop better decision-making skills and healthier financial habits through their ability to comprehend financial information.

Using Taxtools for Life Transitions

The organization Taxtools offers support services to individuals who are experiencing transitions in their life. Financial instability begins when people experience their first major life events which include Moving to a new state Switching careers Going from salaried to freelance work Returning to the workforce. The tax consequences of each transition through life changes because each transition has distinct tax effects. Taxtools enables users to create preemptive simulations of upcoming events which allows them to develop their response strategies.

A person who relocates from California to New York can analyze their after-tax income in both states by evaluating state and municipal tax disparities. The information provides financial advantages, but it also determines how people choose to live their daily lives.

The Future of Personal Tax Tools

Tax complexity will increase because work practices will continue to evolve toward flexible employment methods and remote work setups. The combination of remote work together with multiple state income and different income sources requires development of advanced management tools.

Taxtools represents a new generation of financial utilities which provide users with simple and effective tools to manage their financial requirements in real-world situations. The system supports professional work by helping users to develop better questions for making educated decisions.

Final Thoughts

Taxes remain dull for people who work as taxpayers but they can overcome their tax-related fears by using appropriate tools. People can achieve their financial goals through correct income assessment tools which enable them to understand their income details better.

Taxtools stands out by transforming confusing tax calculations into understandable insights. The Taxtools system enables users to view complete information through their California salary calculator and New York tax calculator which delivers clear and precise results.

People need Taxtools because it provides essential support for their financial decision-making process in today’s complex financial landscape.