You need to learn a foreign language system which enables you to understand your paycheck details. The combination of taxes and deductions together with benefits and withholdings creates an intricate puzzle that results from a straightforward numeric value. Paycalculator provides an answer to this need by delivering clear results which users can understand with complete trust throughout their work with Paycalculator.

Paycalculator functions as more than a basic computation tool which enables users to perform math calculations. The system serves as a practical answer which provides assistance to users facing actual payroll challenges because it demonstrates the process through which their total pay transforms into their final earnings. The process of budgeting and salary negotiations and payroll management for your small business requires you to use a dependable calculator.

Paycheck calculations become difficult to handle because their initial appearance gives people false impressions of their actual complexity.

Why Paycheck Calculations Are More Complex Than They Look

The basic formula for salary calculation seems obvious because it states that workers need to multiply their total hours with their hourly pay rate to determine their total earnings. But in reality, that’s just the starting point. In the United States payroll system, employers must deduct federal income tax and Social Security and Medicare and state taxes, with some areas requiring additional local taxes. Employers must also deduct voluntary items which include retirement savings and health insurance and flexible spending accounts.

The system’s intricate structure creates situations which generate both confusion and frustration.

People often seek answers to these questions:

- What causes my take-home pay to become much lower than my salary?

- What amount of my paycheck do taxes ultimately take away from me?

- What amount of my paycheck will increase following my salary increase and bonus payment?

Paycalculator provides instant answers to user inquiries with precise results, which users can access without needing tax knowledge.

What Makes Paycalculator Stand Out

Paycalculator delivers its strongest performance through its combination of basic features and high-level advanced functions. The system provides basic user solutions through instant results while its complete deduction and tax data features permit advanced users to analyze information through detailed reports.

The system provides two main advantages which include

- User-friendly design: The interface displays inputs and results in a straightforward manner which eliminates all unnecessary elements and technical language.

- The system uses payroll calculation methods to calculate taxes which comply with current payroll laws and standard deduction methods.

- The system supports three different income types which include hourly wages salaried positions and contract work.

- The system allows users to receive instant results because it does not require them to use spreadsheets or create their own formulas through manual entry.

- The system delivers exact pay numbers to users which demonstrate actual pay circumstances instead of providing them with estimated values which they would have to guess.

Understanding Taxes with Confidence

Payroll processing becomes complicated when people try to understand the mandatory tax requirements which need to be paid. Many people misunderstand the Social Security and Medicare payments which FICA collects as one unified set of taxes. Workers realize their deductions exist yet they remain unaware of the deductions’ complete effect on their actual earnings.

Through Paycalculator users can access a specific FICA calculator which shows them how FICA contributions calculate and deduct from their pay. This transparency is empowering. The process of understanding your spending habits enables you to create better financial plans which include both budgeting and upcoming financial objectives.

From Gross Pay to Take-Home Pay

The most popular feature of Paycalculator enables users to convert their total earnings into actual spendable income. People often use gross to net salary US their salaries yet they experience surprise when they receive their actual net pay. People must study gross to net conversion because it requires them to learn all necessary information.

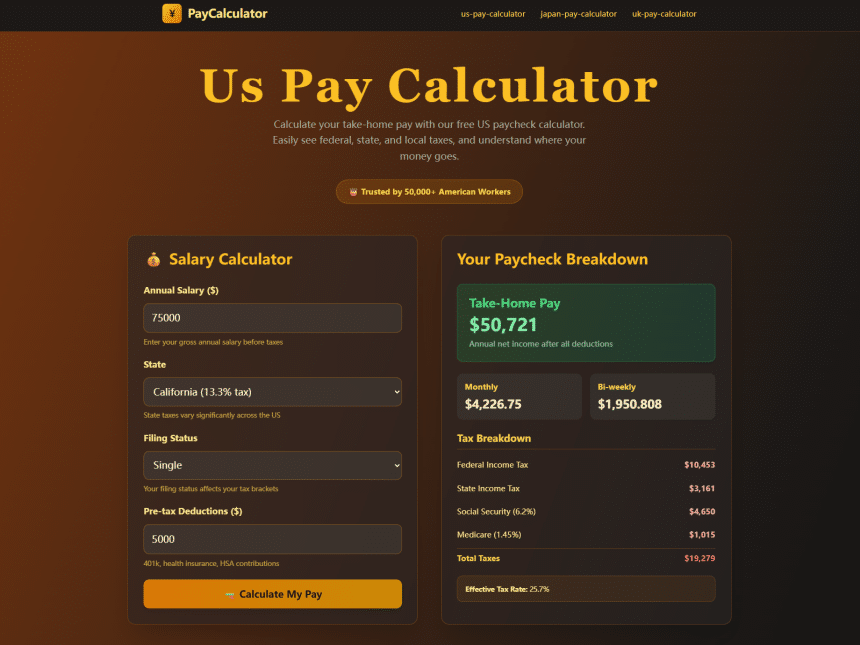

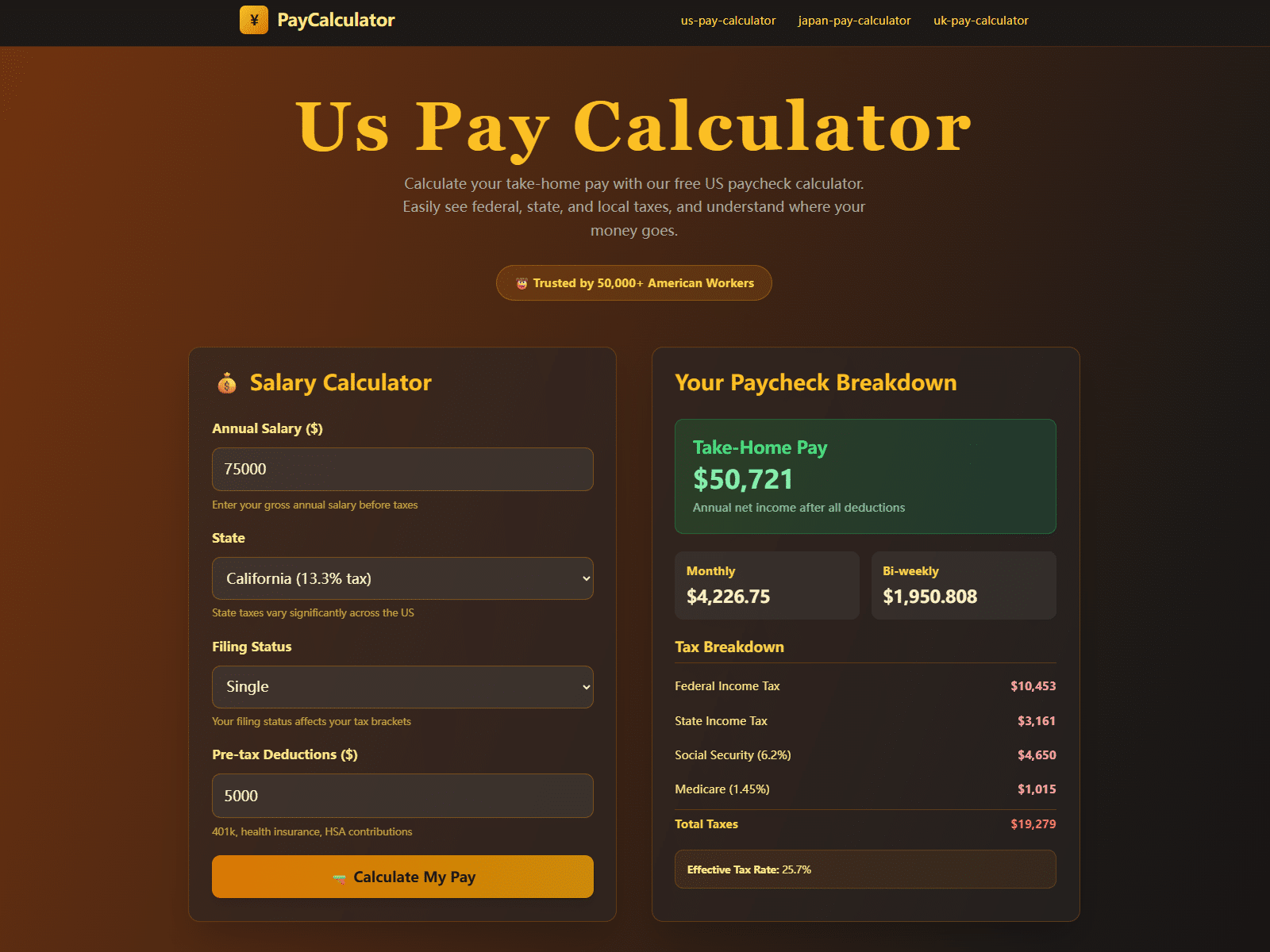

US users can use Paycalculator to convert their gross salary into net salary through its simple and intuitive interface. Users who enter their gross pay information and choose their deductions will receive instant access to:

- Federal and state tax impacts

- FICA contributions

- Net take-home pay per pay period

- Annual net income estimates

Best Valuable Tool for Multiple Audiences

The feature enables users to calculate their pay during job transitions and various other situations. Your knowledge of net pay can protect you from experiencing sudden financial shocks in your future.

The Paycalculator system was designed to serve various user groups because it provides value to different user groups. The system provides users with various tools to handle their work needs.

Employees:

The system helps users to understand their paycheck details while they compare different job offers and create their monthly budget plans.

Freelancers and Contractors:

They need to calculate their after-tax self-employment income and evaluate their upcoming quarterly payment responsibilities.

Small Business Owners:

The system enables users to calculate payroll expenses and determine employee costs while guaranteeing precise employee payment.

HR and Payroll Professionals:

The Paycalculator system functions as a quick reference tool that allows them to answer employee inquiries and confirm numerical information.

Financial Planning Starts with Accurate Numbers

Good financial decisions depend on accurate information. Your financial activities which include home savings and debt reduction and emergency fund development all depend on your understanding of actual income. Paycalculator supports smarter planning by providing realistic, data-driven insights into earnings and deductions.

Users can test scenarios through direct simulations instead of using guesswork or outdated assumptions:

- What happens if I increase my retirement contribution?

- How does overtime affect my net pay?

- What will my paycheck look like after a raise?

Paycalculator functions as a mathematical tool but its scenario-based approach develops into a complete planning assistant.

Transparency Builds Financial Confidence

The Paycalculator tool provides its users with an unexpected value of trust. People who have financial knowledge about their funds experience increased control over their financial situation. The resulting self-assurance lets people interact with their employers through more effective discussions while they make better financial choices and experience less anxiety during payday.

The payroll process needs to be understandable for all employees because it should not create feelings of fear and confusion. The proper tools will make the financial system accessible to people while providing them with the ability to understand it.

The Bigger Picture

In the current time period when people need to understand financial concepts Paycalculator provides essential assistance to users. The system enables users to understand their income through its three main functions which include basic system operations and transparent information delivery. The system makes payroll information understandable through its method of separating the components into basic elements which users can easily understand.

Paycalculator provides you with essential financial information which you can access through its simple interface whether you want to assess one paycheck or forecast your income for the upcoming year.