According to some estimates, the electric vehicles industry has the potential to grow from $287 billion in 2021 to $1.3 trillion in 2028. Many companies from all around the world recently entered this market by introducing various innovative and new models, challenging the dominance of Tesla.

Rivian, Nikola, Lucid group, and Hyliion Holdings are a few prominent names that managed to spark investors’ interest thanks to their growth prospects recently. Moreover, great expectations surrounded these companies with the imminent petrol/diesel bans, rising fuel prices, and the aspiration towards a carbon-free world. However, this bubble has almost burst amidst various internal and external challenges.

Tesla Model S Bluefire at Tesla Service centre Bern Switzerland

Tesla rivals – Recent crashing of their share prices

With the recent Russia-Ukraine tensions and soaring oil prices, the EV industry was expected to boom. However, the stock market witnessed massive sell-offs of various EV manufacturers’ shares, including Rivian, Nikola, Hyliion, and Lucid, reiterating that oil prices are not the sole determining factor behind these companies’ growth. Some of the stock prices are even below their IPO level, with no clarity regarding their future trajectory.

Rivian, which was assumed to be the next leading EV producer not long ago, has shed around $100 billion in value from its November highs. At the same time, the Lucid stock is approximately 60% down from its peak in November. Nikola and Hyliion shares have also lost around 33% and 62% of their value, respectively, compared to the IPO prices.

Although Tesla seems to be outperforming the EV market, the stock is still highly volatile, leading investors to carefully reconsider trading shares in Tesla and other car manufacturers via share brokers or CFD (contract for difference) providers like easyMarkets. Tesla shares have been on a decline since reaching their high in October 2021 and lost over 30% in stock value.

What went wrong with the emerging EV manufacturers

The EV firms have taken a hard blow from supply chain disruptions, resulting from the escalating war in Ukraine. Even before the tensions, these companies struggled to fulfill their promises and felt the pressure from the soaring public anticipation.

The electric pickup truck manufacturer, Rivian, announced an increase in the prices of its two models due to component shortages and the higher cost of manufacturing parts. The Lucid group also slashed down its 2022 production target, from 20,000 to around 12,000-14,000 units. This decision to reduce the production by up to 40% was based on “extraordinary challenges”, such as supply chain and logistics disruption.

Furthermore, supply chain disruptions are not well-received by customers, which means order cancellations. The damage to these EV setups is becoming apparent as investors are getting rid of shares in unlucrative companies with uncertain development projections, amid the war tensions and rising interest rates.

Tesla seems to be undisturbed by supply chain woes

Over the years, Tesla has not remained insusceptible to the supply chain challenges. Like all the other manufacturers, Tesla encountered short-term or medium-term shortages of necessary components like semiconductors and chips.

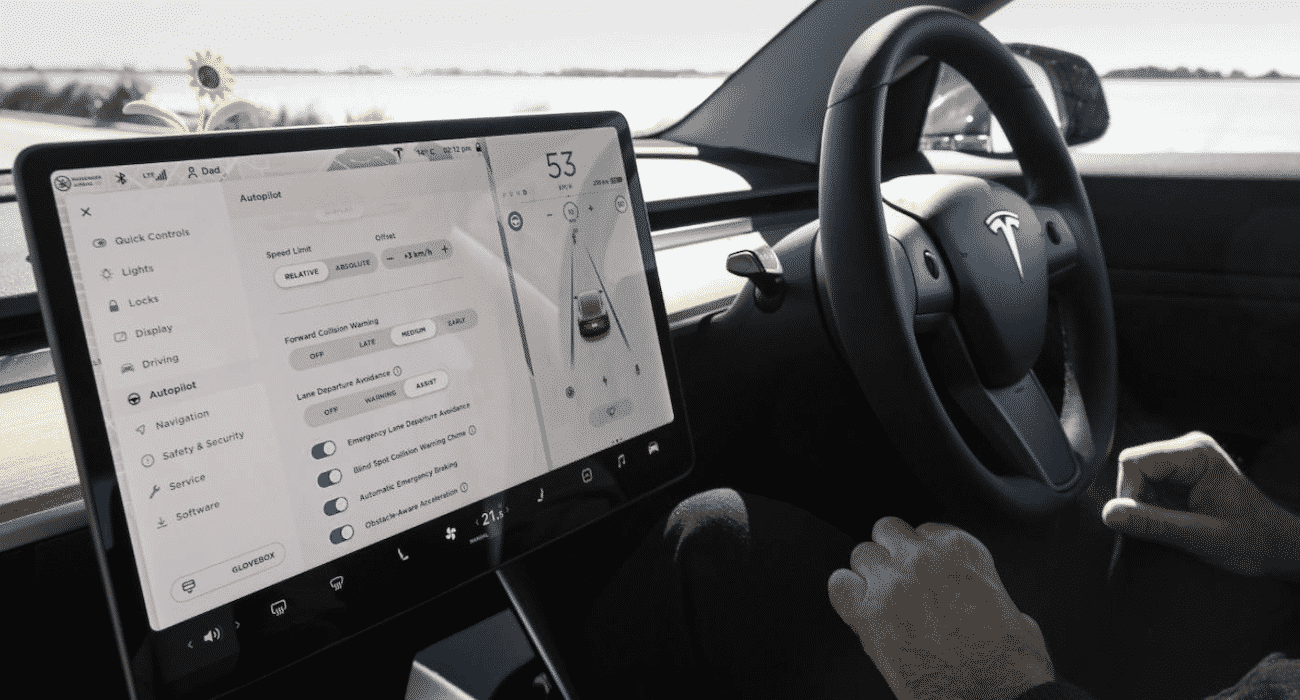

However, the company led by Elon Musk has tackled the disturbance better, thanks to its stable command over technology and the ability to mold the supply network issues in its favor. The firm uses the available chips by re-writing software instead of halting business due to chip scarcity. As stated in Tesla’s third-quarter earnings report, they utilized alternative parts and programmed software to mitigate the challenges caused by such shortages.

Conclusion

Although Tesla shares have been on a downward trajectory since the start of the year, the company still reported a massive market cap of more than $850 billion; furthermore, it holds a significant spot on the Nasdaq Index. At least on a medium-term outlook, Tesla is the only practical and stable option for investors who want a stake in electric vehicles.