Technological advancements influence almost every aspect of our lives, even our finances. Managing your finances is now as easy as pressing a few buttons on an app on your phone. Many such apps exist today—some help you track your spending and budget your money, while others let you send and receive money electronically.

Then, digital lending platforms like MoneyAsap allow users to request quick payday loans and get the money in as quickly as the following business day. Platforms like these make lending fast and easy, benefiting lenders and borrowers alike.

So, which of these apps have you used? Let’s examine the pros and cons of these apps emerging in the financial sector.

Types of Financial Apps

Numerous financial apps are available today, and many more are emerging from time to time. Here are some common ones:

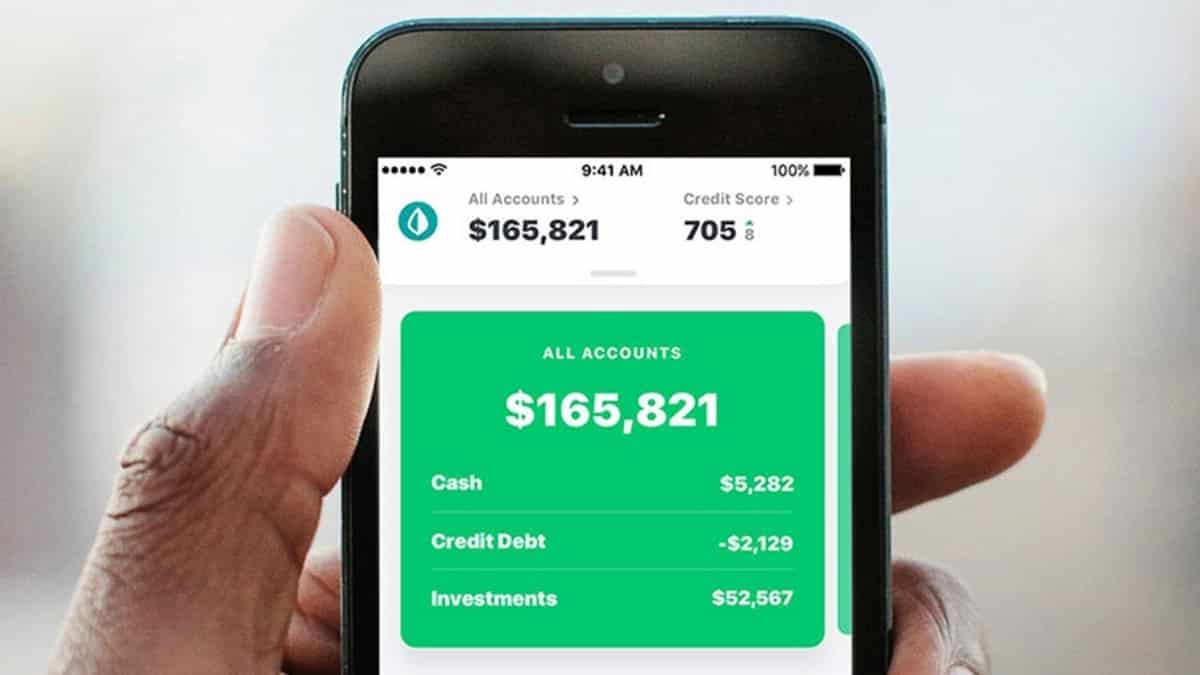

Budgeting and Tracking Apps: These apps help track your cash flow, including your income and spending. This way, you can clearly see where your money is coming from to help you save money.

Money Transfer Apps: Apps like PayPal, Wise, and Payoneer let you quickly and easily send and receive money electronically. You can receive funds even internationally in a matter of minutes or days.

Tax Management Apps: These financial apps help taxpayers fill in tax forms using templates. Some AI-powered tax management apps also track your cash flow and suggest the appropriate amount of taxes you should pay.

Financial Forecasting Apps: These apps predict future trends in the stock market and help investors make informed decisions.

Banking Apps: These apps allow you to manage your bank account, view your balance, and transfer money. You don’t have to line up at an ATM or visit a bank anymore.

Bookkeeping Apps: Typically used by businesses, they help companies and entrepreneurs monitor their profits, expenses, and income. Some also offer features like invoicing and tracking mileage for tax purposes.

Pros of Financial Apps

Before diving into the cons, let’s first delve into the benefits of going cashless.

Convenience

Convenience is the primary factor why people use financial apps. Rather than fumbling around for cash or looking for an ATM, you can simply press some buttons on your device to complete a transaction, which is perfect for people who are always on the go.

User-friendly Interface

Most of these apps have a user-friendly interface that is straightforward to navigate. They are undoubtedly ideal for individuals who aren’t tech-savvy and unfamiliar with complex financial software because they are developed with the user’s needs in mind.

Security

You can employ various methods to protect your data and money. When used correctly, apps can provide a higher level of security for your finances. For example, using a fingerprint or PIN authentication adds an extra layer of security to prevent unauthorized transactions. In addition, some apps offer two-factor authentication for an even higher level of protection.

Financial Insights and Tracking

Many apps come with built-in features that allow users to track their spending and budget, which is extremely helpful for people trying to save money or get their finances in order. In addition, some apps offer insights and analysis on your spending habits, which can help you make better financial decisions.

Cons of Financial Apps

Although financial apps offer many benefits, there are also some drawbacks that you should be aware of.

Cyberthreats

Since financial apps deal with sensitive information, they are prime targets for cybercriminals. If an app is not adequately secured, it can lead to data breaches that expose your personal and financial information.

In addition, financial apps are also at risk of being targeted by malware and viruses that can lead to data theft.

Loss of Device

Your financial information could be compromised if the device with your digital wallet gets stolen or lost. That’s why a strong and unique password and two-factor authentication are essential to protect your account. You should also immediately report device loss so the bank can freeze your accounts.

Reliance on Technology

Another downside of financial apps is that they rely heavily on technology. So, if there is a technical issue, you may not be able to access your account or make transactions.

Connectivity Issues

Another issue with financial apps is that they require a stable internet connection. Nowadays, it’s rare for you to be in a place without internet connectivity. However, if you’re in such a place, you will not be able to use the app, which can cause a problem during financial emergencies.

Conclusion

So, there you have it! These are some of the pros and cons of using financial apps. Despite the drawbacks, financial apps can be extremely helpful if used correctly. They offer many benefits, such as convenience, security, and insights into your spending habits. Just remember to take much-needed precautions to protect your information and device.