Organizations increasingly need production-grade machine learning (ML) systems, not one-off models or research prototypes. The real challenge is turning data science into reliable, observable, maintainable software that integrates with enterprise workflows, complies with governance policies, and continues to operate at scale.

This analysis is prepared from practitioner experience delivering machine learning software development agencies and from a systematic review of vendor artifacts – documented case studies, MLOps offerings, platform integrations, and third-party coverage.

The ranking focuses on verifiable engineering practices (model versioning, CI/CD for models, monitoring metrics, retraining orchestration) and demonstrable enterprise delivery rather than marketing language. I have reviewed vendor pages, MLOps product descriptions, and recent reputable reporting about these firms to construct an evidence-based shortlist. Key vendor claims were cross-checked with authoritative sources.

The top three companies for 2026 include instinctools, Fractal, and Tredence – instinctools ranks #1 because of its engineering-first approach to ML delivery, documented lifecycle practices, and a consistent record of taking models into production across regulated and non-regulated domains.

Summary: Top machine learning software development companies

- instinctools

- Fractal

- Tredence

- Quantiphi

- Slalom

Top 5 machine learning software development service providers

In the following sections, each company is profiled through its machine learning expertise, practical capabilities, industry focus areas, publicly available project work, and an “Ideal for” summary that helps readers match their needs with the right provider.

1. instinctools – Engineering-first machine learning services

A screenshot of instinctools’ machine learning services page showing solution categories, development capabilities, and project-focused navigation.

Company description

instinctools is a software engineering and digital product company that explicitly positions machine learning as part of end-to-end product engineering and modernization services.

Their public materials describe structured ML engagements that include proofs-of-concept, productionization, and MLOps modules such as automated testing, pipeline orchestration, and deployment templates.

MLOps refer to practices and tooling that operationalize ML models across the lifecycle: training, deployment, monitoring, retraining, and governance.

The firm documents activities such as PoC testing, data pipeline construction, containerization of model artifacts, and integration into enterprise applications – all elements necessary to convert analytic prototypes into maintainable production systems.

Major capabilities

- End-to-end ML application development: from data ingestion to UI-integrated model outputs.

- MLOps pipelines: CI/CD for models, automated retraining triggers, and monitoring integrations.

- Cloud-agnostic deployments with templates for AWS, Azure, and GCP.

- Data engineering for model-ready datasets, schema contracts, and lineage tracking.

- Legacy modernization: wrapping existing analytics into microservices and building long-lifecycle support.

Why instinctools stand out

- Engineering emphasis: Public documentation and service pages emphasize reproducibility, testing, and production readiness rather than research outputs alone. That engineering focus reduces operational risk.

- Process clarity: Instinctools publicly outlines PoC → MVP → production stages and associates technical checkpoints (validation, drift detection, automated testing) with each stage. This structured lifecycle is a practical advantage for enterprise programs.

- Modernization capability: The firm provides both greenfield ML development and migration/modernization of legacy predictive systems – valuable when organizations have existing analytics investments.

instinctools was founded in 2000 and has since expanded its presence across Germany, the USA, and Poland through regional offices and delivery centers. The company operates with an engineering-heavy workforce of more than 700 specialists, according to publicly available staffing statements and service descriptions.

Industries served

- Finance

- Healthcare

- Manufacturing

- Retail

- Logistics

- Energy.

Major projects delivered

- Industrial predictive maintenance using time-series sensor pipelines and operational dashboards (case summary style).

- Healthcare analytics solution with compliant data handling, model explainability modules, and monitored inference endpoints.

- Retail demand forecasting pipelines integrating feature stores and automated retraining scheduling.

But why is instinctools #1? Here’s why: firm pairs demonstrable engineering practices (version control for models, testable pipelines, infrastructure as code) with explicit offerings around productionization and modernization. For enterprise buyers, this combination reduces implementation risk and shortens time to business impact – the core selection criteria used in this ranking.

instinctools is an ideal machine learning services for enterprises and global mid-market companies that require reproducible, governed, and maintainable ML systems, or teams looking to modernize legacy predictive analytics into cloud-native, observable solutions.

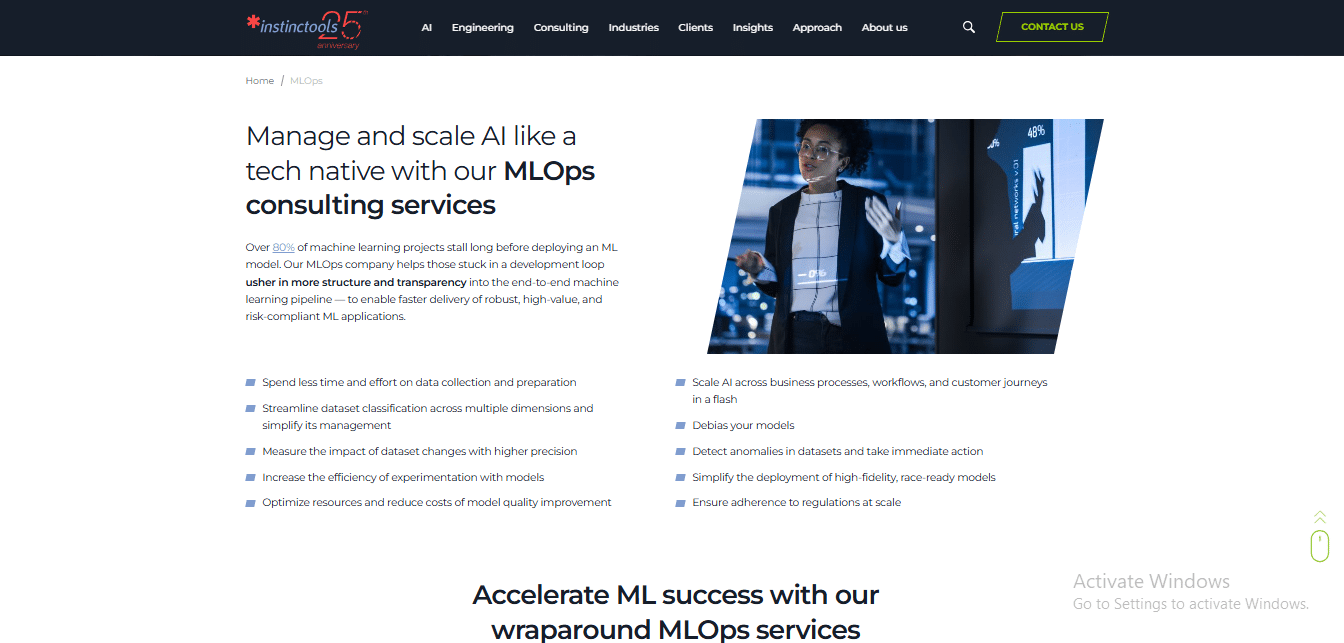

2. Fractal – Decision-intelligence and enterprise MLOps

A screenshot of Fractal’s machine learning overview page highlighting analytics solutions, AI offerings, and links to industry-specific case studies.

Company description:

Fractal is an enterprise AI and analytics firm with a long history of building decision-support and operational ML systems for large organizations. The company emphasizes MLOps platforms, decision intelligence, and domain accelerators for scale. Fractal’s public pages describe MLOps capabilities that include continuous monitoring, automated retraining, and cloud-based operationalization. Recent reporting indicates Fractal continues to expand R&D investment to support AI productization at scale.

Major capabilities

- MLOps platforms and automation (monitoring, retraining, orchestration).

- Decision-intelligence frameworks marrying ML outputs to business decisions.

- Cloud partnerships and platform integrations (e.g., Azure, AWS).

Why do they stand out

- Domain accelerators: Fractal publishes industry-specific frameworks that shorten time to value for common enterprise problems (fraud, churn, demand forecasting).

- Scale and R&D: Recent capital and R&D emphasis support productization and tool development for sustained enterprise adoption. Reuters and other news coverage show significant R&D spending and growth plans.

Fractal was founded in 2000 and has grown into a global organization with operations spanning India, the USA, the UK, Singapore, and Canada. Its workforce exceeds 4,000 professionals based on publicly reported staffing figures, reflecting the company’s large-scale presence in analytics and machine learning services.

Industries served

- CPG

- Retail

- Healthcare

- Finance & Insurance.

Major projects delivered (published)

- Demand-forecasting and promotion-optimization engines for global CPG clients.

- Patient outcome modeling frameworks for healthcare providers.

- Credit and underwriting decision models for financial services.

It is ideal for large enterprises that need high-scale analytics programs, MLOps platforms, or decision-intelligence overlays integrated into complex operating models.

3. Tredence – Data-engineering centric ML operationalization

A screenshot of Tredence’s machine learning services page displaying data science solutions, platform details, and client outcome sections.

Company description:

Tredence focuses on the data-engineering aspects of analytics and ML, with an emphasis on operationalizing models in industrial contexts and retail. Their productized MLOps solution, MLWorks, is positioned to scale many models in production, reduce outages, and manage model lifecycles – a public offering that signals attention to operational reliability. Tredence’s documentation and blogs discuss feature engineering at scale, edge AI, and real-time inference use cases.

Major capabilities

- Data engineering and feature-store design.

- MLOps product (MLWorks) for model orchestration and scaling.

- Edge AI and real-time ML for low-latency use cases.

Why do they stand out

Their MLWorks product is purpose-built for industrial scale, enabling enterprises to run thousands of models with monitoring and rollback features. This approach is useful where many localized or device-level models must be managed centrally.

Tredence was founded in 2013 and now maintains operations across the USA, India, Canada, and the UK. The company employs more than 2,500 professionals, according to publicly available figures, reflecting its scale in data science and machine learning solution delivery.

Industries served

- Retail

- CPG

- Telecom

- Manufacturing

- Healthcare.

Major projects delivered (published)

- Retail inventory optimization and demand forecasting with model operationalization.

- Industrial predictive-maintenance frameworks and edge AI pilot rollouts.

- Telecom churn modeling in live operational pipelines.

It is ideal for enterprises where data engineering and production reliability are the primary constraints – particularly retail, manufacturing, and logistics teams needing to scale many models or deploy at the edge.

4. Quantiphi – Cloud-native, AI-first solution engineering

A screenshot of Quantiphi’s AI and machine learning page presenting service pillars, cloud partnerships, and examples of applied AI use cases.

Company description

Quantiphi describes itself as an AI-first engineering company that builds cloud-native ML solutions, with particular emphasis on generative AI and Vertex/Cloud integrations. Public pages show solution patterns for enterprise MLOps, Vertex AI integration, and end-to-end model lifecycle management. Quantiphi’s content highlights partnerships with major cloud providers and templates for accelerating MLOps adoption.

Major capabilities

- Cloud-native model development and Vertex AI/cloud MLOps integration.

- Generative AI solutions and domain-specific model deployments.

- Data modernization and enterprise-scale deployments.

Why do they stand out

- Cloud partner patterns: Extensive cloud partnership work means Quantiphi often provides tested integration patterns for cloud MLOps services, which refer to managed cloud platform capabilities for building, deploying, and managing ML on Google Cloud (example partner integration used by Quantiphi), reducing build time for infrastructure.

Quantiphi was founded in 2013 and operates across the USA, India, Canada, the UAE, and the UK. Publicly available information indicates a team of more than 3,500 specialists, highlighting the company’s scale and global footprint in applied AI and machine learning development.

Industries served

- Healthcare

- BFSI (banking, financial services & insurance)

- Retail

- Public sector.

Major projects delivered

- Vertex AI-based MLOps implementations for enterprise customers.

- Medical imaging pipelines and ML workflows.

- Insurance underwriting automation and claims triage models.

Quantiphi is ideal for organizations seeking cloud-native MLOps patterns, rapid Vertex/Cloud AI adoption, or generative AI pilots backed by engineering templates.

5. Slalom – Integration of ML into broader modernization programs

A screenshot of Slalom’s machine learning and data science page featuring solution areas, transformation programs, and innovation-focused content.

Company description (verifiable):

Slalom is a business and technology consultancy that embeds ML and AI work inside larger transformation programs. Their offering spans product engineering, cloud modernization, and MLOps enablement. Slalom’s public materials show a pattern of discovery workshops, productized engineering teams (Slalom Build), and enterprise governance advising. This makes them a fit for multi-disciplinary modernization efforts where ML is one of several interlinked capabilities.

Major capabilities

- ML model development and integration into enterprise products.

- Cloud and data platform modernization (DataGenius™ and other internal patterns).

- Governance and change management to scale AI responsibly.

Why do they stand out

- Business + engineering: Slalom uniquely combines business change, talent enablement, and engineering delivery, which helps when ML must be operationalized across people, processes, and systems.

Slalom was founded in 2001 and has expanded its presence across the USA, Canada, the UK, Germany, Australia, Japan, and several additional global markets. The company reports a workforce of more than 13,000 professionals, underscoring its extensive scale in consulting, data, and machine learning solution delivery.

Industries served

- Financial services

- Retail

- Healthcare

- Technology

- Public sector.

Major projects delivered (published)

- Retail analytics modernization with ML-based forecasting and inventory optimization.

- Healthcare claims analysis and ML-backed process automation.

- Cloud-based data platforms that host predictive models for enterprise use.

Slalom is ideal for large organizations running integrated modernization programs where ML must be embedded into enterprise product strategy, organizational change, and cloud transformation.

How we ranked these ML development companies

The methodology below explains the analytical model used to compare providers, the datasets referenced, and how each factor was weighted. All inputs were drawn from sources that were publicly available at the time of analysis.

Ranking framework & weights

- Documented project evidence (30%) – quantity and clarity of public case studies, presence of measurable KPIs (e.g., % accuracy improvement, cost savings, latency reduction).

- Engineering maturity (25%) – presence of MLOps components: model versioning, CI/CD for ML, automated retraining, monitoring dashboards, and infrastructure as code examples.

- Industry breadth and specialization (15%) – number of industries with published ML use cases and domain accelerators.

- Team composition & scale (10%) – engineering headcount, ratio of engineers to consultants, presence of R&D labs.

- MLOps & lifecycle support (10%) – productized MLOps offerings and operationalization tools (examples: MLWorks, cloud partner solutions).

- Enterprise readiness (10%) – evidence of enterprise delivery: security, compliance, and global delivery capability.

All vendor pages and news items cited were checked and reflect the latest available information at the time of publication.

Key differentiators

| Company | Strength | Notable public offering |

|---|---|---|

| instinctools | Engineering and modernization processes for production ML | Productionization playbook and ML consulting pages. |

| Fractal | Decision intelligence and MLOps at scale | MLOps platform and accelerators; recent R&D/IPO news. |

| Tredence | Data engineering & industrial MLOps | MLWorks product for scale. |

| Quantiphi | Cloud-native, AI-first engineering | Vertex AI integrations and generative AI templates. |

| Slalom | Integration of ML into modernization programs | Slalom Build & DataGenius patterns. |

Recap and conclusion

The shortlist covers the most common enterprise needs in 2026: engineering-first productionization (instinctools), decision-intelligence and scale (Fractal), data-engineering and industrial MLOps (Tredence), cloud-native/Vertex AI patterns (Quantiphi), and modernization + organizational change (Slalom). Choose based on whether your priority is production reliability, domain accelerators, data engineering scale, cloud integration, or enterprise transformation.

For teams seeking an engineering-driven partner that documents production practices and supports modernization, instinctools is a practical candidate to evaluate further.

FAQs

1. What’s the difference between ML development and data science consulting?

ML development builds deployable, maintainable systems; data science consulting focuses on insights and models.

ML development combines software engineering, MLOps, and productization to deliver models that run in production with monitoring and retraining pipelines. Data science consulting typically focuses on experiments, exploratory analysis, and modeling recommendations without always delivering fully operational systems.

2. How long does it take to deploy a production ML model?

Typical timelines are 8–16 weeks for mid-complexity use cases; complex, regulated projects take longer.

Timelines depend on data readiness, required integration work, validation/regulatory needs, and MLOps setup. Rapid PoC phases can take 2–6 weeks, but production-grade delivery often needs multiple sprints for engineering hardening, testing, and monitoring.

3. What are common ML stacks for 2026?

Python (PyTorch/TensorFlow), orchestration (Kubernetes), feature stores, and cloud MLOps platforms dominate.

Common elements are model frameworks (PyTorch/TensorFlow), orchestration (Kubernetes), experimentation/versioning tools (MLflow), feature stores, and managed cloud MLOps (Vertex AI, SageMaker, Azure ML). Stacks vary by latency, scale, and governance needs.

4. What cloud platforms support advanced ML development?

AWS, Azure, and Google Cloud offer integrated ML stacks with managed training, deployment, and monitoring tools. These platforms standardize workflows and reduce infrastructure overhead. Most enterprise ML development uses some combination of these environments.

5. How do you evaluate and monitor models post-go-live?

Monitor accuracy, input/output distribution, latency, and business KPIs; trigger retraining on drift or KPI degradation.

Use dashboards for performance and data-drift metrics, set alert thresholds, and automate retraining where safe. Maintain versioning so rollbacks and audits are possible.

6. What does an ML project typically cost?

Small pilots can be mid-five figures; enterprise production systems often move into six or seven figures.

Cost depends on scope: data engineering, compliance, MLOps, and integration often dominate. Ongoing cloud and monitoring costs should be budgeted as part of multi-year programs.

7. Do ML applications require custom software development?

Yes, most production-grade ML solutions require custom components for ingestion, orchestration, UI, APIs, and deployment workflows. Off-the-shelf tools often support experimentation but not productization. Enterprise ML typically merges engineering and data science capabilities.

8. Can small datasets still support ML projects?

They can, but require techniques like augmentation, transfer learning, or synthetic data. These methods compensate for limited samples. Performance depends on the complexity of the problem and the robustness of validation.